Tax + Finance + AI for Entrepreneurs

Stop leaving thousands to the IRS. We use cutting-edge AI and advanced tax code knowledge to reduce

your tax burden and grow your net worth.

Rated 4.9 Stars (out of 5) on Google

Keep More of What

You Earn

Discover the strategies smart entrepreneurs use to legally cut their tax bills and keep more of their income.

Get Commercial Real Estate Funding

Discover how business owners secure funding for property deals and unlock real estate equity — without traditional bank restrictions.

Automate & Scale

with AI

Discover how smart businesses use AI to automate tasks, save hours, and boost productivity — no tech team required.

Expertise, Trust, and Authority...

Since 1969

AS SEEN ON

Media appearances only. No endorsement implied.

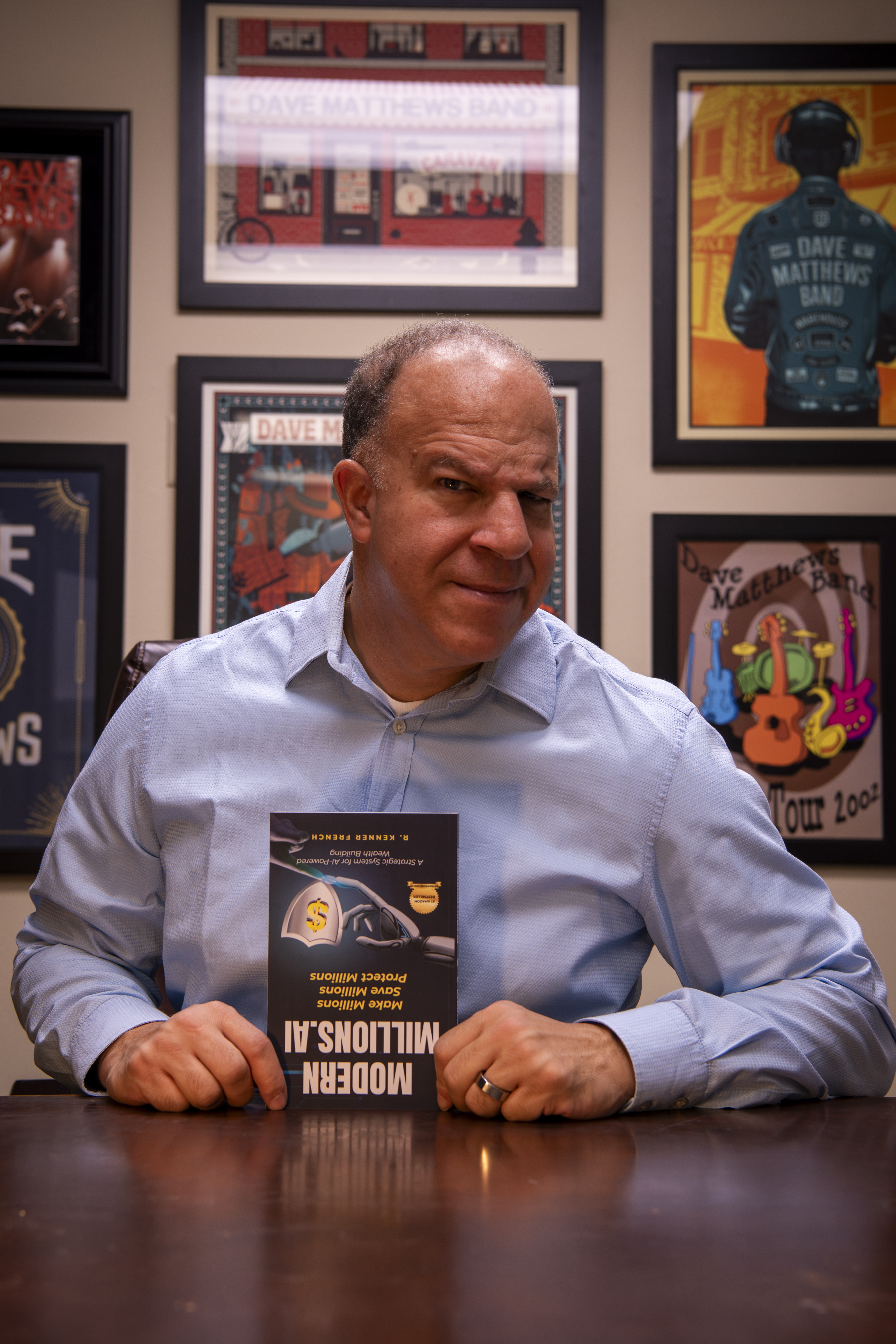

VastSolutionsGroup.com (based on Bainbridge Island, WA) - the award winning tax strategy consulting firm which has been mentioned on NBC, Fox News, and ABC - is led by R. Kenner French, a #1 Amazon top selling author (ModernMillions.ai), a former Forbes.com small business contributor, Tax & AI Contributor to The AI Journal, four-time author, and keynote speaker.

Founded in 1969 as Seamount Financial Group by Gary Koontz, VastSolutionsGroup.com is a legacy firm with a national footprint, dedicated to proactive financial strategy.

Our integrated team of Attorneys, CPAs, and Licensed Financial Advisors are pioneers in applying artificial intelligence technology to ensure clients receive comprehensive, multi-disciplinary guidance.

Today, services also include commercial property finance, qualified plan consulting, risk analysis, M&A, and many more added value matters important to the modern day entrepreneur.

It is a co-founding partner of VastAssetDefense.com, helmed by noted attorney Bob Bluhm, which also has the goal of assisting entrepreneurs in their daily struggles to mitigate taxes, increase financial assets, and help preserve them.

National Expertise, Local Tax Code Mastery

Comprehensive Tax Strategy & AI-Powered Financial Planning

PROACTIVE strategies focused on legally reducing tax burden for entrepreneurs, leveraging tax code sections few traditional advisors utilize.

Integrated financial consultation covering personal wealth, retirement planning, and commercial property finance for a unified strategy.

Proprietary AI Modeling

Our proprietary, advanced AI modeling system analyzes financial data and tax laws to predict outcomes, identify risks, and optimize your strategy for maximum savings.

Mergers & Acquisitions

Specialized M&A advisory focused on minimizing transaction tax liability and structuring deals to optimize your long-term financial outcome.

Risk & Financial Advisory

Proactive risk mitigation and consulting to protect your assets, ensure compliance, and structure your business for maximum financial stability.

Qualified Retirement Plans

Custom design and administration of Qualified Plans (401(k), Profit Sharing, Defined Benefit) to maximize employee benefits and reduce the owner's taxable income.

Why Entrepreneurs Choose Vast Solutions Group

Our Commitment to Expertise, Results, and Trust

Proactive, Forward-Looking Strategy

We don't react to last year's taxes; we actively structure your business and investments to save you money in the years to come.

Advanced Tax Code & AI Modeling

We leverage proprietary AI systems and deep domain expertise to find legal deductions and optimize structures that traditional firms simply overlook.

We Believe YOU Come First

Your net worth is our sole focus. We operate with a fiduciary mindset, ensuring all advice is tailored to maximize your wealth, not ours.

The Vast Advantage: Our Proven 3-Step Path

How We Deliver Tax Reduction and Financial Stability

First Step

Second Step

Third Step

AI-Powered Discovery

We audit your current tax and financial structure using AI models to uncover overlooked tax code savings and system inefficiencies your previous advisor missed.

Advanced Strategy Design

We design a proactive, custom tax, AI, and financial strategy tailored specifically to your business, legally maximizing your future savings.

Deploy & Future-Proof

emphasize tax law changes.We implement your new strategy and continuously optimize it to protect your results against legislative changes and guarantee long-term financial stability.

Choose Your Tax Strategy Consultation Package

Invest in Your Future: Tax Strategy Packages with Proven ROI

Select the tax strategy package that matches your business complexity and financial goals. Every tier is designed to generate tax savings that exceed the investment.

Basic Tax Strategy

$ 2,999

Annually

Basic Consultation

Proactive Tax Strategy

Proactive Financial Strategy

Strategy Library Access

Enhanced Tax Strategy

$ 4,999

Annually

All in Basic +

Quarterly Strategy Check-Ins

Tax Preparation (1 Personal + 1 Business Return)

Priority Email Response (48-Hour Guarantee)

Enterprise Business

$ 10,999

Annually

All in Enhanced +

Monthly Executive Strategy

Sessions

Monthly Cloud-Based Bookkeeping

Dedicated Account Manager

OR, If You Are Unsure Which Tier is Right for You:

The Vast Vault:

Exclusive Tax Strategy Community

For only $199 a month, gain exclusive access to premium content, direct consultation opportunities, and networking with top entrepreneurs, including Sharon Lechter, Johnathan Cronstedt, Loral Langemeier, and more.

Verified Client Reviews &

Authority Trust Score

Join a Team Redefining Tax and Financial Strategy

Are You Ready to:

Master cutting-edge AI and advanced tax strategy?

Directly impact entrepreneurs' net worth? Achieve true professional and financial freedom?

We provide proprietary AI tools, national expertise, and flexible support to ensure your success.

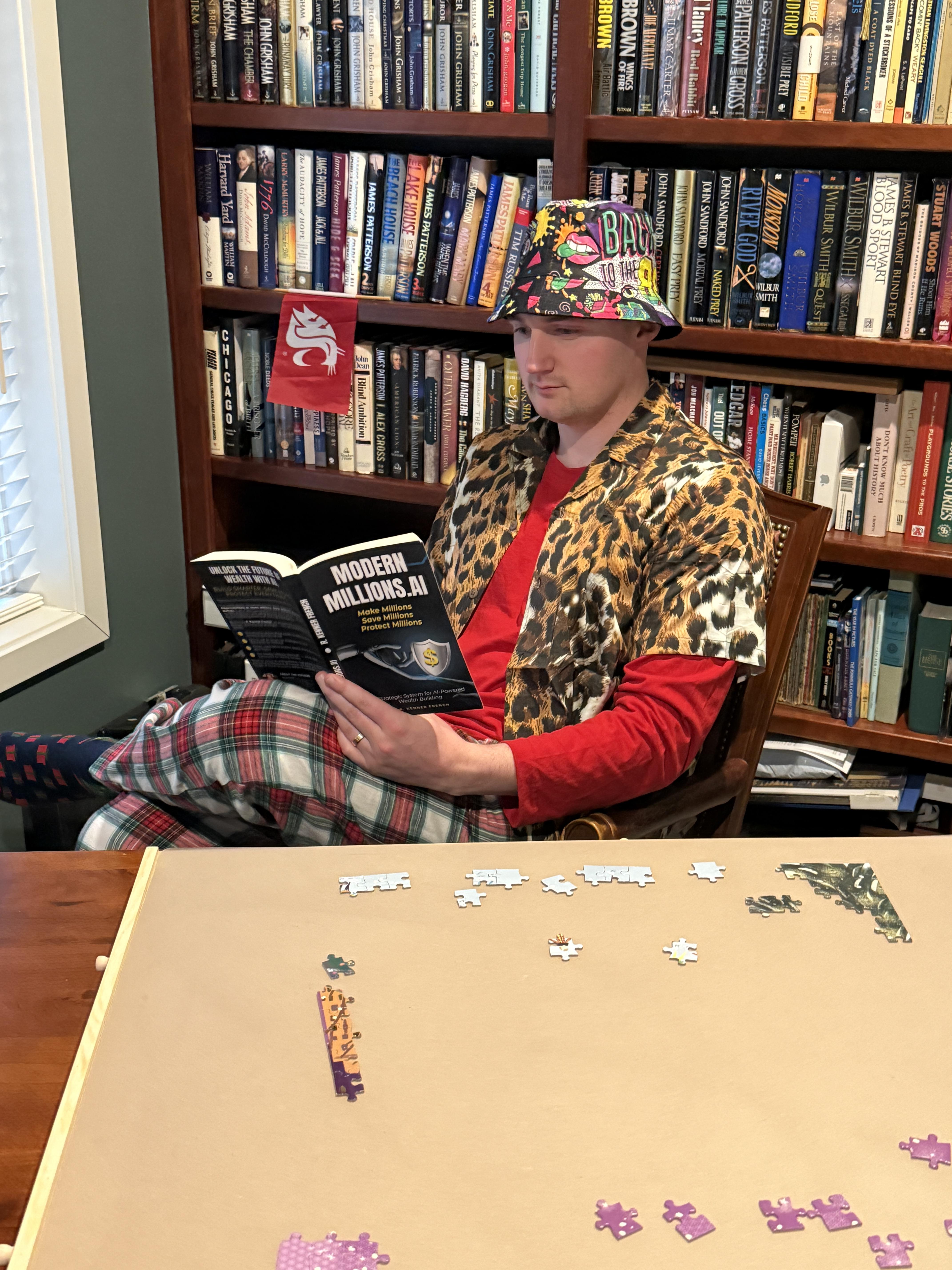

Live Event Tour:

Learn from #1 Bestselling Author R. Kenner French

Join R. Kenner French, author of the #1 Bestselling Amazon book, ModernMillions.ai (Entrepreneurship category), live on the fall-spring tour.

This nationwide event series reveals how today's entrepreneurs can use AI, automation, and tax strategy to build scalable, future-proof businesses.

Ideal for founders, investors, and advisors seeking smarter business growth.

He will be a guest of such personalities as Sharon Lechter, Tom Krol, Jay Conner, Ron LeGrand, Bob Bluhm, and many others.

Smart Tools. Straight Answers. Secure Access.

VastBookke.ai — AI-Powered Bookkeeping

Smarter bookkeeping powered by artificial intelligence.

Designed for modern entrepreneurs, small business owners, and solopreneurs who want:

🔹 Automated transaction categorization

🔹 Real-time financial visibility

🔹 Tax-Ready Financial Reports with zero manual data entry

Visit VastBookke.ai

FAQs — Common Questions, Clear Answers

Have questions about:

🔹 Modern tax strategy?

🔹 How AI tools support financial automation?

🔹 How to work with Vast?

We’ve got detailed answers — updated for both search engines and human clarity.

Browse FAQs

Secure Client Portal — Login for Current Clients

Already working with us?

Access your encrypted portal 24/7 to:

🔹 View Encrypted Financial Documents and Reports

🔹 Upload Tax Data or Bookkeeping Files Securely

🔹 Send Encrypted Messages to Your Strategist

Log In to Portal

Headquarters

755 Winslow Way East, Suite 101, Bainbridge Island WA 98110

Call

(415) 212-8189

Site

www.VastSolutionsGroup.com